TPD

Claims

If you are suffering an illness or have been injured at work to the point where you can no longer perform your duties, you may be eligible to make a TPD insurance claim. The general standard required (though this does vary between insurers) is that if you have suffered an injury or an illness that prevents you from working in the same capacity as before, you may be able to make a Total and Permanent Disability Claim.

At Revolution Law, we are experienced with Total and Permanent Disability Claim matters and have a deep understanding of what it takes to make successful TPD claims. In addition, our team of experienced lawyers have a wonderful client history, just check out our reviews.

Not entirely sure if you could be eligible for a Total and Permanent Disability (TPD) claim? If your employer is paying your superannuation, there may be a TPD insurance policy in place for you. Most superannuation funds typically have TPD insurance attached to their policies. This cover is there to protect you in the unfortunate circumstance that you are seriously disabled and unable to work again.

Valuable Legal Advice When You Need it Most

If you or a loved one cannot continue working because of an illness or injury, it is often a stressful, painful, and somewhat tricky situation for you and/or them as they adjust to a new way of life. At Revolution Law, we take every case for TPD claims seriously and will be able to tell you, in a free consultation, whether you’re likely to succeed in your claim.

We regularly find that our clients will try to self-litigate a TPD claim before engaging us, but quickly realise how complex this process can be. On the surface, many people think that it’s just an insurance claim, and how hard can it be? Unfortunately, these clients have the unwelcome opportunity to experience first-hand just how confusing, stressful, and complex TPD claim matters can be. Revolution Lawyers are trained and have the experience to understand exactly what is needed – and when it’s needed – when it comes to a TPD claim and can provide you with much-needed support and guidance to make the claims process smooth.

We know the importance that our clients place on accessing their benefits promptly due to the difficult circumstances they are experiencing. Unfortunately, self-litigating a TPD Claim can not only extend the process. Still, it can significantly increase the chance of an unsuccessful claim, particularly as the first attempt to claim is so important.

Don’t risk drawing out your claims process – Get on with live and get a pro on it.

What You Need for Your TSP Insurance Claims

The eligibility you may have to make a TPD claim will be outlined in your superannuation or insurance company’s policy documents – and these can often be difficult to go through. Our team of expert solicitors can help you cut through the legal-speak and make sure you understand every part of what you need to do.

Regardless of the policy you have, you’ll generally be required to show a minimum level of disability. You’ll also most likely have a waiting period of some sort – which is standard for most superannuation policies. In some cases, you’ll also need to show a history of employment with a company or a certain number of hours worked each week.

You may have multiple policies with super funds that you may not even know. We can search to identify any other super funds that may have TPD insurance attached to them at the injury.

What Does my Total Permanent Disability Claim Provide?

When you are injured, or ill, there is not only your lost income to think about – there is a whole host of other potential issues that you can come up against. There are medical fees, appointments, potential modifications to make to your house and anything else you may need to make your life comfortable and secure.

When seeking a TPD claim, our legal team can help you see exactly what you can claim for and how much you may be entitled. Of course, we know that our clients would much rather never have suffered the injury or illness in the first place – but the insurance payment you may receive does go some way to alleviate the difficulty you may be facing.

TPD

Claims

If you are suffering an illness or have been injured at work to the point where you can no longer perform your duties, you may be eligible to make a TPD insurance claim. The general standard required (though this does vary between insurers) is that if you have suffered an injury or an illness that prevents you from working in the same capacity as before, you may be able to make a Total and Permanent Disability Claim.

At Revolution Law, we are experienced with Total and Permanent Disability Claim matters and have a deep understanding of what it takes to make successful TPD claims. In addition, our team of experienced lawyers have a wonderful client history, just check out our reviews.

Not entirely sure if you could be eligible for a Total and Permanent Disability (TPD) claim? If your employer is paying your superannuation, there may be a TPD insurance policy in place for you. Most superannuation funds typically have TPD insurance attached to their policies. This cover is there to protect you in the unfortunate circumstance that you are seriously disabled and unable to work again.

Valuable Legal Advice When You Need it Most

If you or a loved one cannot continue working because of an illness or injury, it is often a stressful, painful, and somewhat tricky situation for you and/or them as they adjust to a new way of life. At Revolution Law, we take every case for TPD claims seriously and will be able to tell you, in a free consultation, whether you’re likely to succeed in your claim.

We regularly find that our clients will try to self-litigate a TPD claim before engaging us, but quickly realise how complex this process can be. On the surface, many people think that it’s just an insurance claim, and how hard can it be? Unfortunately, these clients have the unwelcome opportunity to experience first-hand just how confusing, stressful, and complex TPD claim matters can be. Revolution Lawyers are trained and have the experience to understand exactly what is needed – and when it’s needed – when it comes to a TPD claim and can provide you with much-needed support and guidance to make the claims process smooth.

We know the importance that our clients place on accessing their benefits promptly due to the difficult circumstances they are experiencing. Unfortunately, self-litigating a TPD Claim can not only extend the process. Still, it can significantly increase the chance of an unsuccessful claim, particularly as the first attempt to claim is so important.

Don’t risk drawing out your claims process – Get on with live and get a pro on it.

What You Need for Your TSP Insurance Claims

The eligibility you may have to make a TPD claim will be outlined in your superannuation or insurance company’s policy documents – and these can often be difficult to go through. Our team of expert solicitors can help you cut through the legal-speak and make sure you understand every part of what you need to do.

Regardless of the policy you have, you’ll generally be required to show a minimum level of disability. You’ll also most likely have a waiting period of some sort – which is standard for most superannuation policies. In some cases, you’ll also need to show a history of employment with a company or a certain number of hours worked each week.

You may have multiple policies with super funds that you may not even know. We can search to identify any other super funds that may have TPD insurance attached to them at the injury.

What Does my Total Permanent Disability Claim Provide?

When you are injured, or ill, there is not only your lost income to think about – there is a whole host of other potential issues that you can come up against. There are medical fees, appointments, potential modifications to make to your house and anything else you may need to make your life comfortable and secure.

When seeking a TPD claim, our legal team can help you see exactly what you can claim for and how much you may be entitled. Of course, we know that our clients would much rather never have suffered the injury or illness in the first place – but the insurance payment you may receive does go some way to alleviate the difficulty you may be facing.

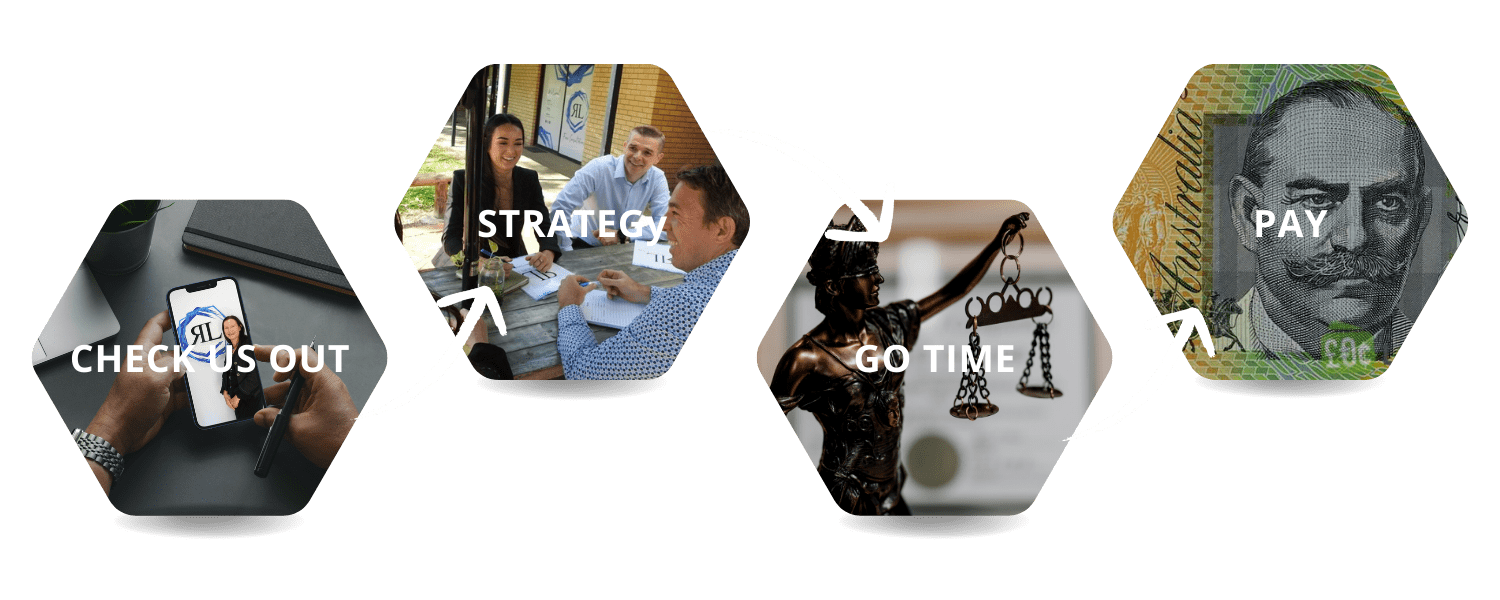

get started…

your claim process

Get Started…

your claim process